Enviromental Data

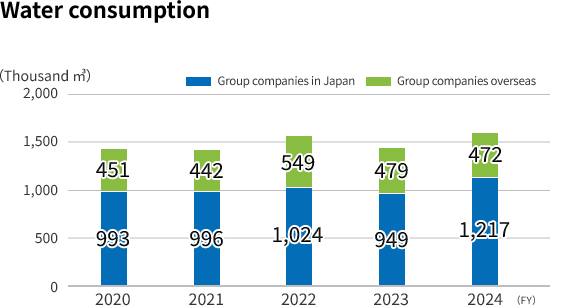

Environmental Activities in FY 2023

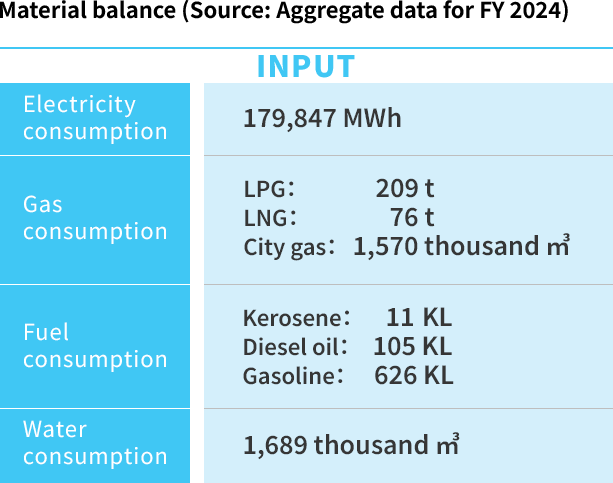

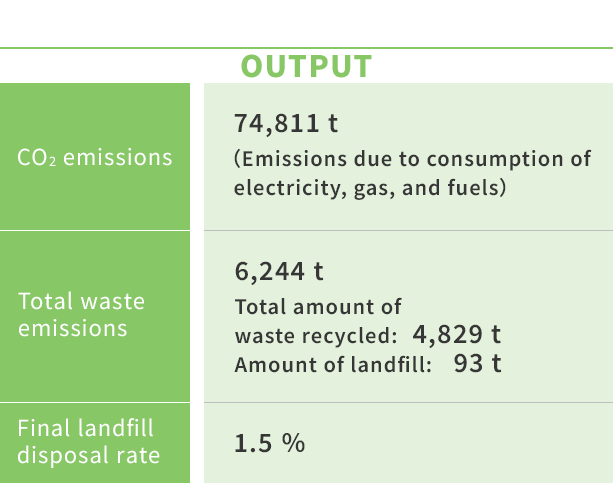

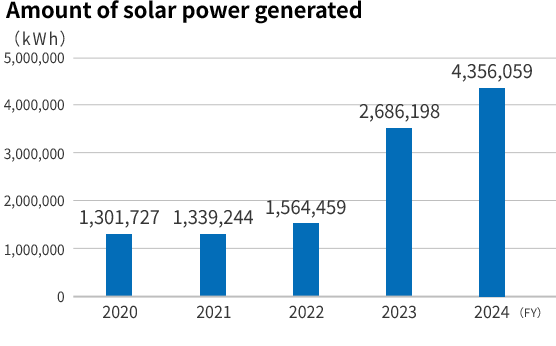

In growth fields such as semiconductors and electronic devices, we are actively investing in regions across the world, with a particular focus on China and South Korea, which are positioned as strategically important regions, and we are promoting capital investment. Regarding the material balance, electricity consumption increased in these strategic regions. To save energy, having set a target of a 1% reduction in greenhouse gas (GHG) emissions compared with the result for the previous year (ULVAC standard), we promoted installation of renewable energy facilities such as solar power generation facilities and vigorous procurement of renewable energy. We have also revised the baseline year for the "Greenhouse Gas Emissions Reduction Target" to 2023 and changed the reduction target from 30% to 50%.

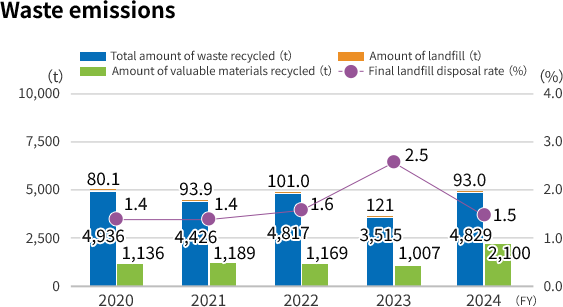

Waste overall emissions have decreased. A significant reduction was observed in waste oil and waste acid, with the reduction in the use of cutting oil due to the renewal of processing equipment in China being a contributing factor for waste oil. There have been no significant changes in other types of waste, and the proportion of waste directed to final disposal relative to total emissions has increased, resulting in a 0.9% increase in the final disposal rate.

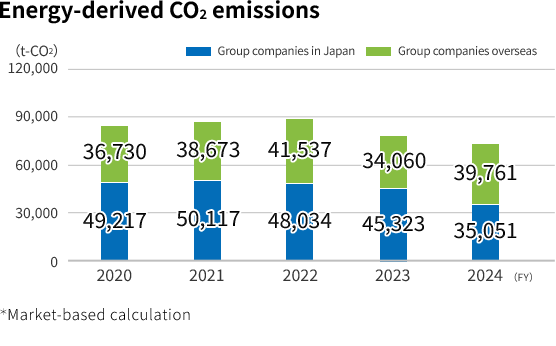

Regarding water, the total water intake decreased by 8% compared to the previous year. The target for reducing unit water consumption* to below the 2020 level (0.77) was also achieved, with a result of 0.55. Going forward, we will continue to manage and work towards reducing our environmental impact related to water.

In the fiscal year in question, we reduced greenhouse gas emissions by 7.1% compared to the previous year. Specifically, the introduction of renewable energy accounted for a reduction of 3,656 tons of CO2, and energy conservation activities contributed to a further reduction of 2,707 tons of CO2.

* Water usage per unit: Water intake / Sales revenue (consolidated)

Efficient Use of Water

There are concerns worldwide about water risks, such as heavy rainfall, flooding, and water shortages, due to ongoing climate change.

We assess and confirm the impact of water risks on our business.

We identify sites exposed to water risks by using the WRI Aqueduct, a water risk assessment tool, focusing on the sites with high environmental impact as defined by the Company. We define sites with extremely high or high baseline water stress as water-stressed areas. The sites exposed to water risks are located in parts of China and Thailand, and account for 8% of the ULVAC Group on a consolidated basis. This includes coating business sites involved in high-environmental-impact, and in addition to the overall group's water usage reduction targets, specific targets are set for each subsidiary, and concrete actions are being promoted.

Management of Chemical Substances

Prior to the use of chemical substances in the manufacturing process, we conduct risk assessment, in which the amount of the substance to be used and the protective equipment necessary are confirmed, in an effort to ensure worker safety and minimize the environmental impact. Moreover, in order to ensure compliance with the environmental regulations of various countries concerning products, a cross-organizational team whose members are drawn from quality assurance, procurement, and environmental divisions is playing a central role in establishing a structure for management of chemical substances contained in products, thus ensuring provision of environmentally friendly products. Furthermore, we collect information in order to appropriately respond to environmental laws and regulations, which undergo frequent revisions, and conduct in-house education on chemical substances contained in products for which external lecturers are invited, thus supporting manufacturing in compliance with environmental regulations. This education is not limited to ULVAC's business divisions but also covers our business partners. We are promoting establishment of a management structure covering the entire supply chain.

Waste Management

Promotion of Waste Material Recycling

ULVAC has been switching the waste material processing agencies to those that are capable of recycling, aiming to promote the recycle of waste materials.

● Waste recycling

We comply with laws and regulations, dispose of waste appropriately, and reduce the amount of waste by taking back equipment that customers no longer need, refurbishing it, and reselling it.

For more details, please visit the ULVAC Techno, Ltd. website. (Japanese only)

● Metal recycling

We will promote the reduction of underground resource consumption through the recycling of metals and the active use of recycled products.

For more details, please visit the ULVAC Techno, Ltd. website. (Japanese only)

Sustainability Data

Greenhouse gases

■CO2 emissions(t-CO2)

| FY2020 Jun. 2021 |

FY2021 Jun. 2022 |

FY2022 Jun. 2023 |

FY2023 Jun. 2024 |

FY2024 Jun. 2025 |

||

| Scope1+2(location-based) | ULVAC Group | 90,933 | 92,052 | 90,305 | 88,362◎ | 91,080 |

| ULVAC Group in Japan | 55,829 | 55,560 | 52,123 | 49,833 | 49,205 | |

| ULVAC Group overseas | 35,105 | 36,492 | 38,181 | 38,528 | 41,875 | |

| Scope1+2(market-based) | ULVAC Group | 85,947 | 88,790 | 89,571 | 79,385◎ | 74,811 |

| ULVAC Group in Japan | 49,217 | 50,117 | 48,034 | 45,323 | 35,051 | |

| ULVAC Group overseas | 36,730 | 38,673 | 41,537 | 34,060 | 39,761 | |

| Scope1 | ULVAC Group | 5,829 | 6,020 | 6,874 | 6,823◎ | 5,884 |

| ULVAC Group in Japan | 4,521 | 4,707 | 5,463 | 4,844 | 3,224 | |

| ULVAC Group overseas | 1,308 | 1,313 | 1,411 | 1,978 | 2,660 | |

| Energy-related | ULVAC Group | 5,829 | 6,020 | 6,398 | 6,733 | 5,660 |

| ULVAC Group in Japan | 4,521 | 4,707 | 4,987◎ | 4,754 | 2,999 | |

| ULVAC Group overseas | 1,308 | 1,313 | 1,411 | 1,978 | 2,660 | |

| Total greenhouse gas emissions excluding energy sources※1 | ULVAC Group | 476 | 90 | 225 | ||

| ULVAC Group in Japan | 476 | 90 | 225 | |||

| ULVAC Group overseas | 0 | 0 | 0 | |||

| HFCs | ULVAC Group | 18 | 0 | 0 | ||

| ULVAC Group in Japan | 18 | 0 | 0 | |||

| ULVAC Group overseas | 0 | 0 | 0 | |||

| PFCs | ULVAC Group | 35 | 6 | 13 | ||

| ULVAC Group in Japan | 35 | 6 | 13 | |||

| ULVAC Group overseas | 0 | 0 | 0 | |||

| SF6 | ULVAC Group | 423 | 85 | 212 | ||

| ULVAC Group in Japan | 423 | 85 | 212 | |||

| ULVAC Group overseas | 0 | 0 | 0 | |||

| Others | ULVAC Group | 0 | 0 | 0 | ||

| ULVAC Group in Japan | 0 | 0 | 0 | |||

| ULVAC Group overseas | 0 | 0 | 0 | |||

| Scope2(location-based) | ULVAC Group | 85,104 | 86,032 | 83,431 | 81,539◎ | 85,196 |

| ULVAC Group in Japan | 51,308 | 50,852 | 46,660◎ | 44,989 | 45,981 | |

| ULVAC Group overseas | 33,796 | 35,180 | 36,770 | 36,550 | 39,215 | |

| Scope2(market-based) | ULVAC Group | 80,118 | 82,770 | 82,697 | 72,562◎ | 68,927 |

| ULVAC Group in Japan | 44,696 | 45,410 | 42,571◎ | 40,479 | 31,826 | |

| ULVAC Group overseas | 35,422 | 37,360 | 40,126 | 32,082 | 37,101 | |

| Scope3 | ULVAC Group | 5,752,603 | 7,630,671 | 7,262,341 | 8,302,365 | |

| By Category | ||||||

| 1. Purchased goods and services (※) |

131,892 | 247,989 | 268,396 | 283,550 | ||

| 2. Capital goods | 21,512 | 22,105 | 49,096 | 59,842 | ||

| 3. Fuel- and energy-related activities | 11,593 | 11,468 | 11,392 | 11,459 | ||

| 4. Upstream transportation and distribution | (Included in category 1) | (Included in category 1) | (Included in category 1) | (Included in category 1) | ||

| 5. Waste generated in operations | 42,504 | 43,257 | 31,267 | 31,755 | ||

| 6. Business travel | 5,531 | 6,752 | 14,698 | 15,340 | ||

| 7. Employee commuting | 2,785 | 2,828 | 2,853 | 2,828 | ||

| 8. Upstream leased assets | (N/A) | (N/A) | (N/A) | (N/A) | ||

| 9. Downstream transportation and distribution (※) |

23,048 | 27,141 | 28,171 | 32,076 | ||

| 10. Processing of sold products | (N/A) | (N/A) | (N/A) | (N/A) | ||

| 11. Use of sold products | 5,513,023 | 7,268,921 | 6,856,222 | 7,865,376 | ||

| 12. End-of-life treatment of sold products | 715 | 210 | 246 | 139 | ||

| 13. Downstream leased assets | (Included in category 11) | (Included in category 11) | (Included in category 11) | (Included in category 11) | ||

| 14. Franchises | (N/A) | (N/A) | (N/A) | (N/A) | ||

| 15. Investments | (N/A) | (N/A) | (N/A) | (N/A) |

(※)ULVAC stand-alone aggregate

◎are assured by an independent third party.

■Renewable energy consumption(MWh)

| FY2020 Jun. 2021 |

FY2021 Jun. 2022 |

FY2022 Jun. 2023 |

FY2023 Jun. 2024 |

FY2024 Jun. 2025 |

||

| Green energy purchases | ULVAC Group | 0 | 0 | 0 | 2,516 | 4,033 |

| ULVAC Group in Japan | 0 | 0 | 0 | 1,210 | 1,315 | |

| ULVAC Group overseas | 0 | 0 | 0 | 1,306 | 2,719 | |

| Green energy certificates | ULVAC Group | 0 | 1,102 | 4,951 | 7,405 | 27,899 |

| ULVAC Group in Japan | 0 | 1,102 | 4,951 | 7,405 | 27,899 | |

| ULVAC Group overseas | 0 | 0 | 0 | 0 | 0 | |

| Solar cell power generation (self-consumption + electricity sales) | ULVAC Group | 1,302 | 1,339 | 1,564 | 2,686 | 4,356 |

| ULVAC Group in Japan | 876 | 928 | 1,150 | 1,743 | 2,009 | |

| ULVAC Group overseas | 426 | 411 | 414 | 944 | 2,347 | |

| Solar cell power generation (self-consumption) | ULVAC Group | 438 | 425 | 662 | 1,596 | 3,266 |

| ULVAC Group in Japan | 438 | 425 | 662 | 1,206 | 1,532 | |

| ULVAC Group overseas | 0 | 0 | 0 | 391 | 1,733 | |

| Total | ULVAC Group | 438 | 1,527 | 5,613 | 11,517 | 35,198 |

| ULVAC Group in Japan | 438 | 1,527 | 5,613 | 8,611 | 30,746 | |

| ULVAC Group overseas | 0 | 0 | 0 | 391 | 4,452 |

■Energy consumption

| FY2020 Jun. 2021 |

FY2021 Jun. 2022 |

FY2022 Jun. 2023 |

FY2023 Jun. 2024 |

FY2024 Jun. 2025 |

||

| Electricity(MWh) | ULVAC Group | 162,979 | 168,152 | 167,203 | 168,848 | 179,847 |

| ULVAC Group in Japan | 102,596 | 104,484 | 98,005 | 98,420 | 100,763 | |

| ULVAC Group overseas | 60,382 | 63,668 | 69,198 | 70,428 | 79,084 | |

| City gas(Thousand m3) | ULVAC Group | 1,275 | 1,346 | 1,402 | 1,120 | 1,570 |

| ULVAC Group in Japan | 801 | 875 | 812 | 816 | 858 | |

| ULVAC Group overseas | 474 | 472 | 591 | 304 | 712 | |

| LPG(t) | ULVAC Group | 240 | 217 | 243 | 200 | 209 |

| ULVAC Group in Japan | 223 | 215 | 241 | 199 | 206 | |

| ULVAC Group overseas | 1 | 2 | 2 | 2 | 3 | |

| LNG(t) | ULVAC Group | 683 | 704 | 658 | 625 | 76 |

| ULVAC Group in Japan | 683 | 704 | 658 | 625 | 75 | |

| ULVAC Group overseas | 0 | 0 | 0 | 0 | 1 | |

| Kerosene(KL) | ULVAC Group | 11 | 12 | 14 | 12 | 11 |

| ULVAC Group in Japan | 11 | 12 | 14 | 12 | 11 | |

| ULVAC Group overseas | 0 | 0 | 0 | 0 | 0 | |

| Heavy oil(KL) | ULVAC Group | 15 | 11 | 6 | 2 | 0 |

| ULVAC Group in Japan | 6 | 0 | 0 | 0 | 0 | |

| ULVAC Group overseas | 9 | 11 | 6 | 2 | 0 | |

| Light oil(KL) | ULVAC Group | 148 | 149 | 140 | 452 | 105 |

| ULVAC Group in Japan | 64 | 61 | 113 | 109 | 59 | |

| ULVAC Group overseas | 84 | 88 | 27 | 343 | 46 | |

| Gasoline(KL)※2 | ULVAC Group | 333 | 735 | 626 | ||

| ULVAC Group in Japan | 333 | 328 | 132 | |||

| ULVAC Group overseas | 407 | 494 | ||||

| Total (GJ) | ULVAC Group | 1,703,206 | 1,756,785 | 1,746,440 | 1,596,305 | 1,656,608 |

| ULVAC Group in Japan | 1,088,362 | 1,110,509 | 1,043,436 | 946,996 | 926,367 | |

| ULVAC Group overseas | 614,026 | 646,300 | 703,004 | 649,309 | 730,241 |

※1 The method for tracking gas usage has been revised.

※2 Starting in fiscal year 2022, gasoline usage within Japan was included. Starting in fiscal year 2023, gasoline usage for all groups was included in the scope of aggregation.

■Reduction measures targeting CO2 emissions: Major initiatives

| Measure | Site | CO2 reduction results (metric tons CO2/year) Cost-cutting (thousands of yen) |

|

|---|---|---|---|

| FY2024 Jun. 2025 Emission factors(Japan):0.4628 Emission factors(Korea):0.4558 Emission factors(China):0.6094 |

PCW Refrigerator Replacement | Korea | CO2reduction results:147.0 Cost-cutting:3,774 |

| Off-site PPA Operation | Susono site | CO2reduction results:1,300.0 Cost-cutting:- |

|

| On-site PPA Operation | Kyushu site China |

CO2reduction results:1,308.0 Cost-cutting:11,730 |

|

| Non-fossil certificate | Each site | CO2reduction results:12,912.0 Cost-cutting:- |

|

| CO2absorption by ULVAC's Forest Conservation Activities | Chigasaki site | CO2reduction results:49.4 Cost-cutting:- |

Water

Water withdrawals(Thousand m3)

| FY2020 Jun. 2021 |

FY2021 Jun. 2022 |

FY2022 Jun. 2023 |

FY2023 Jun. 2024 |

FY2024 Jun. 2025 |

||

| Service water | ULVAC Group | 616 | 606 | 647 | 581 | 831 |

| ULVAC Group in Japan | 562 | 556 | 596 | 532 | 772 | |

| ULVAC Group in overseas | 55 | 50 | 51 | 49 | 59 | |

| Industrial water | ULVAC Group | 405 | 406 | 513 | 430 | 413 |

| ULVAC Group in Japan | 15 | 14 | 15 | 0 | 0 | |

| ULVAC Group overseas | 391 | 392 | 498 | 430 | 413 | |

| Groundwater | ULVAC Group | 423 | 426 | 413 | 417 | 445 |

| ULVAC Group in Japan | 417 | 426 | 413 | 417 | 445 | |

| ULVAC Group overseas | 6 | 0 | 0 | 0 | 0 | |

| Total | ULVAC Group | 1,444 | 1,438 | 1,573 | 1,428 | 1,689 |

| ULVAC Group in Japan | 993 | 996 | 1,024 | 949 | 1,217 | |

| ULVAC Group overseas | 451 | 442 | 549 | 479 | 472 |

Waste / recycling

■Waste and valuable materials disposal volume

(Metric tons)

| FY2020 Jun. 2021 |

FY2021 Jun. 2022 |

FY2022 Jun. 2023 |

FY2023 Jun. 2024 |

FY2024 Jun. 2025 |

|

| ULVAC Group (Total) | 5,912 | 6,587 | 6,224 | 4,925 | 6,244 |

| ULVAC Group (Recycle) | 4,338 | 4,426 | 3,757 | 3,515 | 4,829 |

| Recycling rate (ULVAC Group) | 98.6% | 98.6% | 98.4% | 97.5% | 98.5% |

| Volume of waste for final disposal(ULVAC Group) | 80 | 94 | 101 | 121 | 93 |

■Breakdown of waste

(Metric tons)

| FY2020 Jun. 2021 |

FY2021 Jun. 2022 |

FY2022 Jun. 2023 |

FY2023 Jun. 2024 |

FY2024 Jun. 2025 |

|

| Sludge waste | 332 | 367 | 322 | 297 | 324 |

| Waste oil | 208 | 388 | 306 | 201 | 194 |

| Waste acid | 254 | 325 | 1,032 | 274 | 371 |

| Waste alkali | 268 | 295 | 359 | 166 | 164 |

| Waste plastic | 391 | 400 | 348 | 293 | 349 |

| Paper | - | 2 | 2 | 13 | 129 |

| Wood scrap | 684 | 648 | 456 | 414 | 378 |

| Scrap metal | 86 | 84 | 48 | 68 | 92 |

| Glass, ceramics | 62 | 59 | 67 | 52 | 45 |

| Slag | 17 | 138 | 106 | 80 | 120 |

| Mixed waste | - | 16 | 9 | 1 | 1 |

| Flammable waste oil | 127 | 3 | 38 | 5 | 92 |

| Strong acid | 922 | 905 | 724 | 777 | 832 |

| Strong alkali | 392 | 334 | 156 | 224 | 332 |

| Toxic waste | 425 | 561 | 376 | 38 | 7 |

| General-purpose paper | 71 | 74 | 44 | 67 | 126 |

■Breakdown of valuable materials

(Metric tons)

| FY2020 Jun. 2021 |

FY2021 Jun. 2022 |

FY2022 Jun. 2023 |

FY2023 Jun. 2024 |

FY2024 Jun. 2025 |

|

| Waste oil | 27 | 13 | 13 | 8 | 11 |

| Paper | 104 | 38 | 49 | 29 | 61 |

| Cardboard | 121 | 132 | 170 | 122 | 263 |

| Waste plastic | 20 | 64 | 32 | 6 | 36 |

| Scrap metal | 828 | 859 | 852 | 816 | 1,678 |

Chemical substances

■Substances subject to the PRTR Act

Boundary:ULVAC Group in Japan

(Metric tons)

| Substance name | Cabinet order number | FY2020 Jun. 2021 |

FY2021 Jun. 2022 |

FY2022 Jun. 2023 |

FY2023 Jun. 2024 |

FY2024 Jun. 2025 |

|---|---|---|---|---|---|---|

| Indium and its compounds | 44 | 28.9 | 49.9 | 30.3 | 21.0 | 18.2 |

| Nickel compound | 309 | 16.0 | 16.0 | 49.1 | 25.6 | 22.0 |

| Molybdenum and its compounds | 453 | 46.3 | 47.6 | 33.3 | 3.3 | 2.6 |

| Boron compounds | 405 | 16.9 | 0.1 | 0.0 | 16.7 | 19.1 |

| Hydrogen fluoride and its water-soluble salts | 374 | 12.4 | 5.4 | 1.4 | 11.3 | 13.9 |

| Chromium and chromium(III) compounds | 87 | 1.6 | 3.1 | 2.9 | 2.4 | 2.9 |

| Xylene | 80 | 1.3 | 1.3 | 1.0 | 0.9 | 0.4 |

| Hydrazine | 333 | 2.4 | 0.0 | 0.0 | 3.2 | 5.0 |

| Silver and its water-soluble compounds | 82 | - | 5.0 | 5.0 | 4.5 | 5.5 |

| Perchloric acid and its ammonium, potassium, sodium, magnesium and lithium salt | 602 | - | - | - | 1.0 | 1.0 |

| Cerium and its compounds | 665 | - | - | - | 1.0 | 1.2 |

| Substance name | Amount of movement (Metric tons) | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Emissions to the atmosphere | Emissions to the water system | Recovery as waste | Product movement amount | |||||||||

| Jun. 2023 | Jun. 2024 | Jun. 2025 | Jun. 2023 | Jun. 2024 | Jun. 2025 | Jun. 2023 | Jun. 2024 | Jun. 2025 | Jun. 2023 | Jun. 2024 | Jun. 2025 | |

| Indium and its compounds | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 30.3 | 21.0 | 18.2 |

| Nickel compound | 0 | 0 | 0 | 0 | 0 | 0 | 3.9 | 5.8 | 4.5 | 45.2 | 19.8 | 17.5 |

| Molybdenum and its compounds | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 33.3 | 3.3 | 2.6 |

| Boron and its compounds | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 16.7 | 19.1 | 0 | 0 | 0 |

| Hydrogen fluoride and its water-soluble salts | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 11.3 | 13.9 | 0 | 0 | 0 |

| Chromium and chromium(III) compounds | 0 | 0 | 0 | 0 | 0 | 0 | 0.2 | 0.1 | 0.1 | 2.7 | 2.3 | 2.8 |

| Xylene | 1.0 | 0.9 | 0.4 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Hydrazine | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 3.2 | 5.0 | 0 | 0 | 0 |

| Silver and its water-soluble compounds | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 4.5 | 5.5 | ||

| Perchloric acid and its ammonium, potassium, sodium, magnesium and lithium salt | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 1.0 | 1.0 | 0 | 0 | 0 |

| Cerium and its compounds | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 1.0 | 1.2 |

■PCB processing status

(Number of units owned)

| FY2020 Jun. 2021 |

FY2021 Jun. 2022 |

FY2022 Jun. 2023 |

FY2023 Jun. 2024 |

FY2024 Jun. 2025 |

|

|---|---|---|---|---|---|

| Transformers | 2 | 2 | 1 | ||

| Capacitors | 4 | 1 | |||

| Fluorescent light ballasts |

■Number of serious legal violations

(Cases)

| FY2020 Jun. 2021 |

FY2021 Jun. 2022 |

FY2022 Jun. 2023 |

FY2023 Jun. 2024 |

FY2024 Jun. 2025 |

|

| Serious legal violations(※) | 0 | 0 | 0 | 0 | 0 |

(※)Serious legal violations:Cases involving administrative penalties and punishments, such as production suspensions and fines

Independent Assurance Report

Independent Assurance Report[PDF/1,001KB]

Environment

This website use cookies to obtain and use access data to understand the convenience and usage of customers. If you agree to use cookies, click "I Accept".

[Privacy Plicy] [Cookie Policy]