Corporate Governance

Basic corporate governance policy and structure

Under its Basic Corporate Philosophy that "the ULVAC Group aims to contribute to the development of industries and science by comprehensively utilizing its vacuum and peripheral technologies through the mutual cooperation and collaboration of the Group companies," ULVAC endeavors to improve its corporate governance with a view toward increasing its corporate value over the medium to long term. From the aforementioned standpoint, the Company values competitive and efficient management by ensuring strict compliance with corporate ethics as well as laws and regulations, while respecting the interests of all stakeholders related to its business activities, including not only shareholders, but also business partners, local communities, and employees.

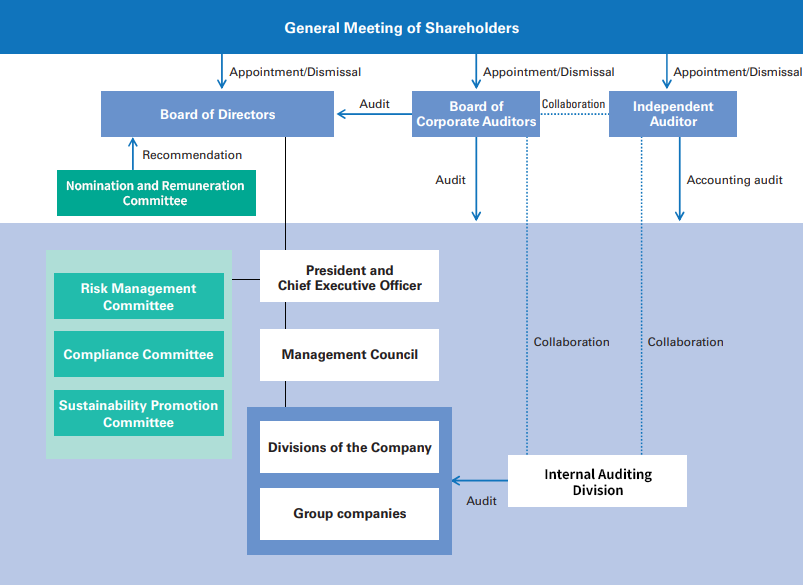

Overview of the Design of Institutional Structures

Corporate Governance Structure

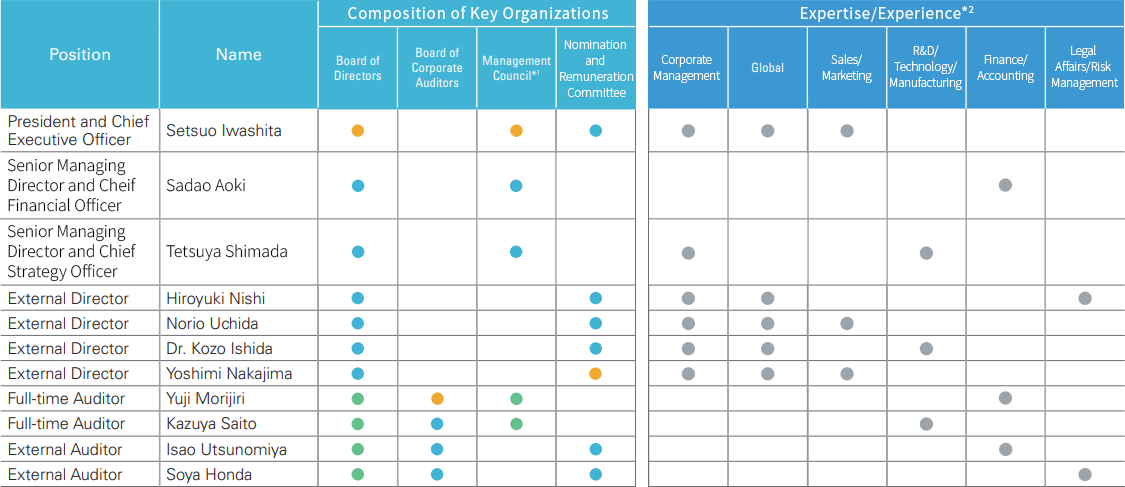

Composition of Key Organizations and Skills Matrix

●Chairperson ●Observer

*1 In addition to the above, executive officers are members of the Management Council.

*2 Main expertise and experience of each director and auditor are indicated.

The above table summarizes the areas regarding which the Company has particular expectations, and is not a description of all their expertise and experience.

Basic Corporate Governance Policy

Basic Corporate Governance Policy (Version 2,established on September 29, 2016)

Corporate Governance Report

Corporate Governance Report(Last Update: September 29, 2025)

Integrated Report